chfa monthly impact report

February Report: Data from January 1 to January 31, 2024

CHFA strengthens Colorado by investing in affordable housing and community development. CHFA’s work supports communities and creates jobs. We are proud to invest in Colorado’s success.

This monthly report provides a year-to-date snapshot of CHFA’s investments to support affordable housing and community development throughout Colorado, along with related narratives and analyses.

Please click here for a printable PDF version of this month’s report.

CHFA

Homeownership

Rental Housing

Business Lending

Community Partnerships

homeownership

325

Total homeowners served with loans

A Hybrid Approach to Homebuyer Education

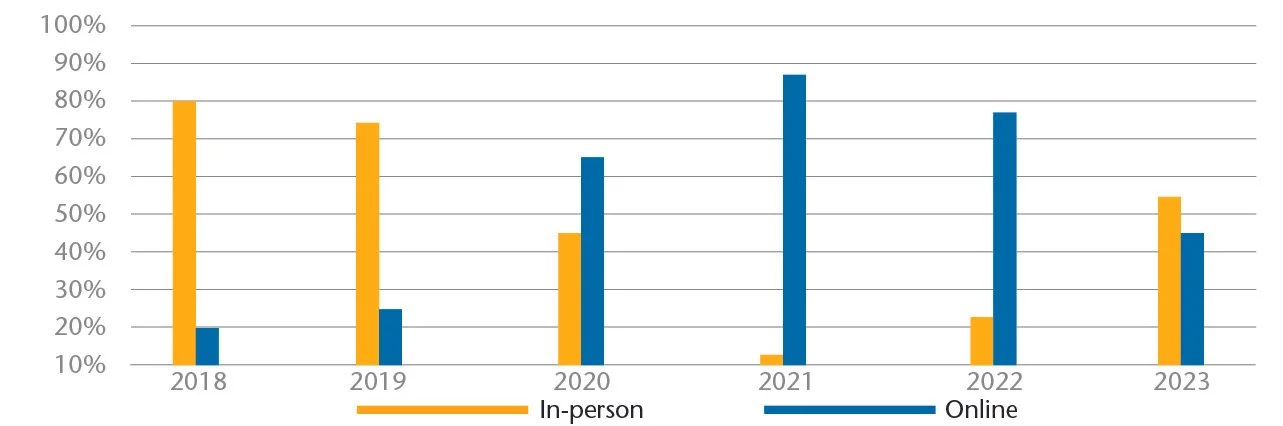

Prior to the pandemic, most CHFA-sponsored homebuyer education classes were held in-person at various locations across the state in partnership with a network of approved homebuyer education providers. Beginning in 2020, there was a move toward online courses as CHFA continued to support first-time homebuyers while adhering to public health guidelines. Today, to accommodate borrower preferences, CHFA continues to partner with its statewide network to offer a mix of online and in-person homebuyer education opportunities.

$115,794,925

First Mortgage Loans

$26,760

Down Payment

Assistance Grants

$4,445,280

Down Payment

Assistance Seconds

325

Homebuyer Education

Customers Served

Customers

$358,129

Median Loan Amount

687

Median Credit Score

$101,549

Median Income

128%

Median AMI

90%

First-time Homebuyers

rental housing

192

Units supported with loans, PAB, or Housing Tax Credits

Clara Brown Commons Opens in Denver

A grand opening celebration was held Friday, January 19th, at the new Clara Brown Commons development in Denver. Sponsored by Mile High Ministries, the development includes 62 apartment homes for individuals and families earning between 20 to 80 percent of the Area Median Income (AMI).

Located in Denver’s Cole neighborhood, Clara Brown Commons is part of the redevelopment of a city block that will include 17 Habitat for Humanity townhomes and a community building with a childcare center. Clara Brown Commons was awarded $782,057 in federal 4 percent Housing Tax Credits and $970,455 in state Affordable Housing Tax Credits in 2020. Chfaians David Dodge, Julia Selby, Kathryn Grosscup, and Meghen Brown attended the celebration.

2

Total Developments Supported

$269,091

Total Loan Production

$3,269,091

Multifamily Loan Commitments

Customers

34

Family Housing Units

0

Supportive Housing Units

158

Older Adult/Senior Units

0

Assisted Living Units

0

Rural Housing Units

0

Special Population Units

34

Preservation Units

0

Veteran Units

business lending

66

Total businesses served

Land Banking Award Recipients Announced

In January, CHFA joined Governor Jared Polis and the Office of Economic Development and International Trade (OEDIT) in announcing 16 recipients of funds from the Proposition 123 Land Banking program. CHFA serves as contract administrator on behalf of OEDIT for the Land Banking program as well as the Proposition 123 Equity and Concessionary Debt programs.

The Land Banking program provides grants to eligible local or tribal governments and forgivable loans to eligible nonprofits with a demonstrated history of providing affordable housing. The 16 awardees are located in urban, rural, and rural-resort-designated counties throughout the state. The land acquisition supported will help advance the development of an estimated 1,380 affordable for-sale and rental housing units. More details including a list of awardees are available at coloradoaffordablehousingfinancingfund.com.

40

Total Jobs Impacted

$2,779,523

Dollars Invested

Customers

30%

Women-owned

56%

Minority-owned

20%

Women- and

Minority-owned

$42,146

Median Loan Amount

community partnerships

20

Organizations supported

Celebrating 50 Years of Strengthening Colorado

In 2024, CHFA is celebrating 50 years of strengthening Colorado by investing in affordable housing and community development. Since 1974, CHFA has had the privilege to collaborate with valuable partners, innovators, and changemakers to build stronger communities through investments to support homeownership, business growth, affordable rental housing development, and mission-aligned nonprofits.

Throughout the year, CHFA will celebrate its impact as well as the partners who have made the work possible and laid the foundation for future efforts. In January, CHFA launched a 50th anniversary webpage at chfainfo.com/50, which will be updated throughout 2024. It includes a link to an interactive timeline that tells CHFA’s story through the years, beginning with its establishment by the Colorado General Assembly in 1973 and the appointment of its first Executive Director and Board in 1974.

$126,356

Total Giving

$0

Corporate Giving

(direct and in-kind)

$44,000

Regional Community

Investment Grants

$82,356

Technical Assistance

7

Staff Community Involvement Leave

and Day of Service Hours

208

Technical Assistance Hours

$0

Staff Donation Drives

and Giving and Match

spotlight

CHFA Welcomes New CRM

CHFA welcomes Kaylee A. Romero as its newest Community Relationship Manager serving the South Central Colorado region, which includes Alamosa, Chaffee, Conejos, Costilla, Hinsdale, Lake, Mineral, Rio Grande, and Saguache counties. An Alamosa resident born and raised in the San Luis Valley, Kaylee most recently served as the Project Director for the College Assistance Migrant Program (CAMP) at Adams State University, where her work centered on supporting migrant seasonal farmworker youth and their families.

Bentley Commons Breaks Ground

Bentley Commons in Colorado Springs broke ground on January 30th, and Terry Barnard, CHFA’s Community Development Lending Manager, took part in the event. CHFA supported the 192-unit development with an allocation of $1,000,000 in state Affordable Housing Tax Credits and $2,735,647 in federal 4 percent Housing Tax Credits in 2022. CHFA also provided a $35.4 million construction loan, of which $12.7 million will convert to a permanent CAPABLE loan, as well as a $600,000 permanent Capital Magnet Fund (CMF) loan, and a $245,000 CMF grant.

Chfaians Take Part in HFA Institute

The National Council of State Housing Agencies (NCSHA) hosted The Housing Finance Agency (HFA) Institute in Washington, D.C., from January 7-12th. Each year, the conference convenes to support HFA staff by strengthening fundamental understanding and advanced techniques on a variety of topics. Brian Miller, Kathryn Grosscup, and Thomas Haffey spoke and led discussions on tackling contract administration challenges, incorporating federal energy dollars into housing, and mortgage revenue bonds, respectively.

Photos:

Hero: Christopher, resident at Mason Place, CHFA rental housing customer, Fort Collins

Homeownership: Terri and Lamont, CHFA homebuyer, Aurora

Rental housing: Clara Brown Commons grand opening celebration

Spotlight, middle: Bentley Commons groundbreaking, courtesy Cody Bracket